prince william county real estate tax assessment

Enter jurisdiction code 1036. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

. A convenience fee is added to payments by credit or debit card. Prince William Virginia 22192. Ad Find Current Property Owner Records for Your County.

Ad Uncover Available Property Tax Data By Searching Any Address. All you need is your tax account number and your checkbook or credit card. Enter the house or property number.

703 792 6780 Phone The Prince William County Tax. When prompted enter Jurisdiction Code 1036 for Prince William County. 4379 Ridgewood Center Drive Suite 203.

By creating an account you will have access to balance and account information notifications etc. Enter the Account Number listed on the. If you have not received a tax bill for your property and believe you should have contact.

If you own real property in Prince William County you need to know how property tax assessments work. Press 1 to pay Personal Property Tax. We Provide Homeowner Data Including Property Tax Liens Deeds More.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. Payment by e-check is a free service. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

No Records No Charge. You can pay a bill without logging in using this screen. Use both House Number and House Number High fields.

Dial 1-888-2PAY TAX 1-888-272-9829. Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County. Prince William County collects on average 09 of a propertys.

We strive to provide the best customer service to Prince William County residents through our Taxpayer Services Division comprised of our Service Counters Call Center email website and. If you have questions about this site please email the Real Estate. July 2 2022.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Learn all about Prince William County real estate tax. Press 2 to pay Real Estate Tax.

Prince William County Virginia Home. Enter the Tax Account numbers listed on the billing. Provided by Prince William County Communications Office.

Press 2 for Real Estate Tax. Then they get the assessed value by multiplying the percent of total value assesed currently 100. Enter Any Address Find Previous Property Owner Records for Your State.

Certain types of Tax Records are available to the. Press 1 for Personal Property Tax. Prince William County Real Estate Assessor.

Hi the county assesses a land value and an improvements value to get a total value. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. The Ultimate Guide to the Prince William County Property Tax Assessments.

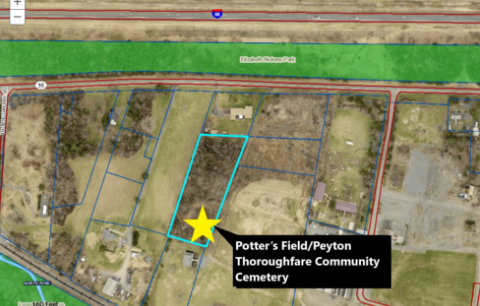

Prince William Board Of County Supervisors Approves Land Purchase In Historic Thoroughfare Community

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William County Set To Open Crisis Receiving Center

New Hours For Taxpayer Services Call Center And Counter Locations

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

The Rural Area In Prince William County

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

The Rural Area In Prince William County

Where Residents Pay More In Taxes In Northern Va Wtop News

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Rise Up And Celebrate Park And Recreation Month With Prince William County

Sticker Shocked County Personal Property Tax Bills Rise Despite Targeted Tax Relief News Princewilliamtimes Com

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com

Prince William Board Adopts Plan For Data Center Tax Hikes Headlines Insidenova Com